Actively Managed Certificates (AMCs)

AMCs are an innovative alternative to traditional investment instruments. Actively managed and securitized, AMCs offer dynamic exposure to a wide range of asset classes, tailored for professional investors.

What Are AMCs?

AMCs are structured financial instruments that provide investors with exposure to a dynamic portfolio of assets, actively managed by a designated investment manager.

Unlike passive products such as traditional index trackers, AMCs allow for regular portfolio adjustments enabling the manager to respond to market developments, seize emerging opportunities, and adapt strategies in real time.

AMCs are listed on the SIX Swiss Exchange AG and issued with a Swiss ISIN (CH-ISIN), making them fully bankable and bookable like traditional securities in custody accounts worldwide.

Key Characteristics of AMCs

Each AMC is overseen by a dedicated investment manager who actively makes trading decisions to pursue defined objectives whether targeting growth, generating income, or implementing hedging strategies. This active oversight ensures the portfolio remains aligned with its strategic goals in changing market conditions.

AMCs are securitized investment instruments issued by regulated financial institutions. Each certificate carries a Swiss ISIN, making it tradable and bookable in custody accounts worldwide just like traditional securities.

AMCs can be structured to include a wide variety of asset classes ranging from traditional investments like equities and bonds to alternative assets such as real estate, private debt, commodities, cryptocurrencies, and even niche portfolios like fine wine or farmland. All within a single, securitized instrument.

As securitized instruments, AMCs can be traded on regulated exchanges or over the counter (OTC), offering greater liquidity and flexibility compared to traditional fund structures. Their standardized format and Swiss ISIN make them easily transferable and bookable across global custody platforms.

AMC providers typically disclose portfolio holdings and Net Asset Value (NAV) daily, offering investors real-time visibility into strategy composition and performance. This level of transparency supports informed decision-making and builds trust in the investment process.

AMCs offer exceptional flexibility allowing investment managers to dynamically adapt portfolio composition without the need to issue a new instrument. This enables real-time strategy adaptation in response to market shifts, opportunities, or evolving investment objectives.

Structured under Swiss law, AMCs avoid the complexity of traditional fund licensing regimes like UCITS or AIFMD. Each certificate is issued with a Swiss ISIN, making it a recognized, bankable security. The structure ensures investor protection through independent oversight, while enabling faster, more cost-effective market access.

AMC platforms manage the full lifecycle structuring, issuance, NAV calculation, reporting, and compliance reducing the need for internal infrastructure. Sponsors can focus on strategy and investor relationships while benefiting from scalable, low-overhead operations.

How Do AMCs Work?

Explore the lifecycle and structure of AMCs, understand how AMCs are created, managed, and traded, and how they offer a flexible, securitized route to dynamic investment strategies.

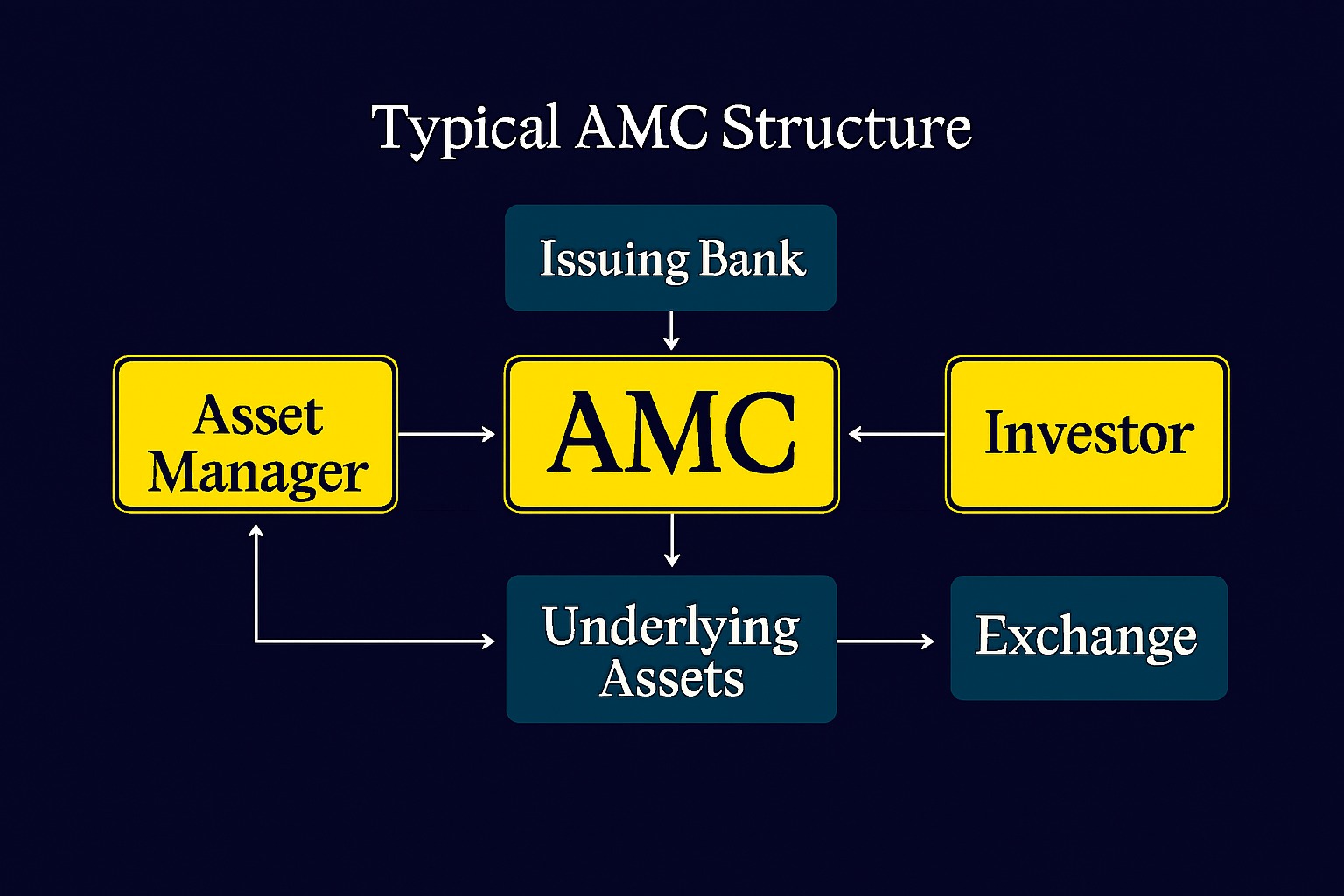

An issuer, typically a bank or Special Purpose Vehicle (SPV) partners with an asset manager to define the investment strategy and select the underlying assets. The AMC is then structured, assigned a Swiss ISIN (CH-ISIN), and listed on the SIX Swiss Exchange, making it tradable and bankable across global custody platforms.

Once issued, the AMC's underlying portfolio is actively managed by the appointed investment manager. They make real-time trading and rebalancing decisions in line with the defined strategy and prevailing market conditions without the need to issue new securities. This ensures agility and responsiveness throughout the lifecycle of the investment.

Qualified investors can access AMCs through their banks or brokers, gaining exposure to actively managed strategies via a single, bankable security. With a Swiss ISIN, AMCs are easily bookable in custody accounts and tradable across global financial platforms.

Investors receive regular updates on the AMC's performance, including daily Net Asset Value (NAV) calculations, current holdings, and execution of the investment strategy. This transparent reporting ensures ongoing visibility and supports informed portfolio monitoring.

Why Choose AMCs?

Advantages

Benefits

Flexible Access to Global Asset Classes

AMCs offer dynamic exposure to traditional and alternative investments.

Global exposure to stocks, corporate and government bonds, and other fixed income instruments.

Invest in direct property, REITs, and large-scale developments across key global markets including the UK, Europe, the US, and the Middle East. Real estate offers steady income potential, long-term capital appreciation, and portfolio diversification.

Access high-growth private market opportunities in sectors like technology and infrastructure. These investments offer the potential for enhanced returns and income generation, often with higher risk and longer investment horizons compared to traditional markets, ideal for investors seeking diversification and long-term capital growth.

Gain efficient exposure to physical assets like gold, silver, oil, natural gas, and agricultural products. Commodities can offer portfolio diversification, inflation protection, and potential returns uncorrelated with traditional markets.

Access leading cryptocurrencies like Bitcoin and Ethereum, tokenized securities, DeFi protocols, and NFTs all within a secure, regulated framework. Tap into the innovation and diversification of the evolving digital economy.

Invest in fine art, rare wines, luxury watches, classic cars, and other high-value collectibles. Through fractional ownership, gain access to exclusive assets with lower capital outlay, while benefiting from diversification, potential appreciation, and inflation resilience.

Who Should Consider AMCs?

Asset Owners

Launch investment strategies faster and more efficiently with AMCs. This flexible, cost-effective alternative to traditional fund structures enables quicker time-to-market, reduced operational complexity, and greater control, helping you attract capital and scale with agility.

Learn More for Asset OwnersQualified Investors

Tailored for high-net-worth individuals and institutional investors seeking access to professionally managed, diversified strategies. AMCs offer the convenience of a bankable security, combined with the sophistication and flexibility of institutional-grade investments.

Learn More for InvestorsReady to Unlock the Potential of AMCs?

Join AMC-Link and gain seamless access to the evolving AMC ecosystem, where innovation meets flexibility in modern investment structuring.