Swiss ISIN Securities

The Trusted Standard Behind Transparent and Secure AMCs

What is an ISIN?

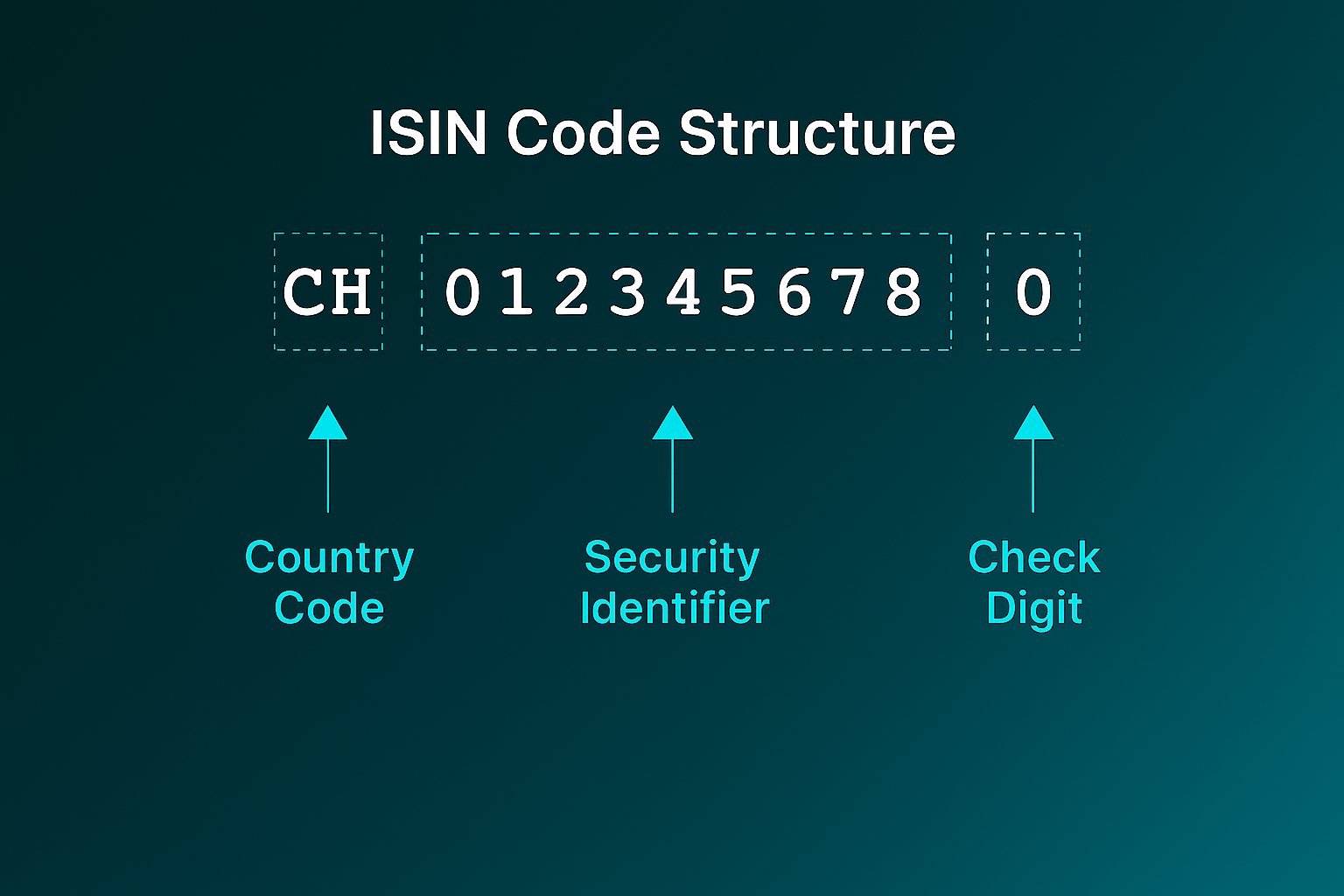

What is an ISIN? An ISIN (International Securities Identification Number) is a globally recognized 12-character alphanumeric code that uniquely identifies a specific security such as a stock, bond, or structured product. It plays a critical role in the financial ecosystem by enabling the clearance, settlement, and accurate recording of transactions across international markets.

A Swiss ISIN, denoted by the prefix "CH", is issued under the jurisdiction of Switzerland, a country renowned for its robust regulatory environment, political stability, and global financial leadership. This designation ensures a high level of trust, transparency, and compliance with international standards.

When applied to AMCs, a Swiss ISIN transforms a bespoke investment strategy into a bankable, regulated security. This allows the AMC to be held in custody accounts, traded on regulated exchanges, and integrated seamlessly into global investment platforms. In essence, the Swiss ISIN bridges the gap between innovative investment strategies and institutional-grade execution, making AMCs accessible, secure, and operationally efficient.

Key Benefits of Swiss ISIN Securities

Why Swiss ISINs are the gold standard for actively managed certificates

Universally accepted identifier that enables seamless cross-border trading and settlement.

Transforms investment strategies into fully bankable securities, eligible for custody in standard investment accounts.

Issued under Switzerland's trusted financial regulatory framework, ensuring compliance and investor protection.

Easily integrated into global banking, brokerage, and wealth management platforms.

Facilitates efficient secondary market trading and ownership transfers, enhancing flexibility.

Offers daily NAV updates, clear fee structures, and comprehensive documentation for informed decision-making.

Backed by Switzerland's reputation as a premier financial centre, instilling confidence among global investors.

Supported by a wide network of custodians and private banks, ensuring broad accessibility and scalability.

The advantages of having a CH-ISIN on your AMC

The Swiss advantage for actively managed certificates

Swiss ISINs can be listed and traded on the SIX Swiss Exchange, providing enhanced visibility, liquidity, and credibility for Actively Managed Certificates.

Switzerland's financial regulations are globally respected for their rigor, transparency, and investor protection standards.

As a premier financial hub, Switzerland offers unmatched trust and stability, enhancing the appeal of CH-ISIN structured products.

Swiss ISINs are fully bankable and widely accepted by global custodians, private banks, and wealth managers.

CH-ISINs integrate seamlessly into existing banking and brokerage systems, streamlining execution, settlement, and reporting.

Recognized and supported across international markets, enabling broader investor outreach and efficient global distribution.

Switzerland offers competitive tax treatment and flexible structuring options for issuers and investors alike.

Swiss AMC issuance processes are efficient and streamlined, enabling faster time-to-market compared to many other jurisdictions.

How Swiss ISINs Work

A Clear Overview of the Process Behind Structuring and Issuing Bankable AMCs

Strategy Design: The investment manager defines the strategy, including asset allocation, risk profile, and investment objectives.

Issuer Onboarding: A Swiss-regulated issuer structures the strategy into an AMC, ensuring regulatory compliance and operational readiness.

ISIN Allocation: The issuer registers the AMC and obtains a CH-ISIN, officially recognizing it as a financial security.

Bankability & Custody: The AMC becomes a bankable instrument, eligible for custody in standard investment accounts across global financial institutions.

Listing on Swiss Exchange (Optional): The AMC can be listed on the SIX Swiss Exchange, enhancing visibility, credibility, and liquidity.

Distribution & Access: Investors can access and invest in the AMC through their existing banks or brokers using the CH-ISIN, just like any listed security.

Ongoing Management: The investment manager actively manages the portfolio, executing trades and adjusting positions in line with the strategy.

Transparency & Reporting: Investors receive daily NAV updates, performance reports, and regular communications, ensuring full transparency and oversight.

The SIX Swiss Exchange

A Premier Venue for AMC Listings

The SIX Swiss Exchange is Switzerland's principal stock exchange and one of Europe's most respected and advanced trading venues. It offers a highly liquid, transparent, and regulated marketplace for a broad range of financial instruments, including equities, bonds, ETFs, and structured products.

For AMCs, listing on the SIX Swiss Exchange delivers a range of strategic advantages:

Public listing increases exposure to institutional and professional investors across Europe and beyond.

Real-time pricing and daily NAV publication provide investors with clear, up-to-date valuation data.

Operates under Swiss financial market law and is supervised by FINMA (Swiss Financial Market Supervisory Authority), ensuring high standards of compliance and investor protection.

Listing on SIX opens the door to a wide network of international investors and wealth managers.

The exchange is known for its robust infrastructure, stringent governance, and commitment to fair and orderly markets.

By listing on the SIX Swiss Exchange, AMCs gain not only credibility but also the operational and regulatory advantages of one of the world's most trusted financial ecosystems.

Unlock the Power of Swiss ISIN Securities

Enhance your investment offerings or portfolio with the unmatched bankability, regulatory clarity, and global recognition of Swiss-issued AMCs.